when will capital gains tax increase take effect

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. TAX has a significant positive influence on return on equity.

Selling Stock How Capital Gains Are Taxed The Motley Fool

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

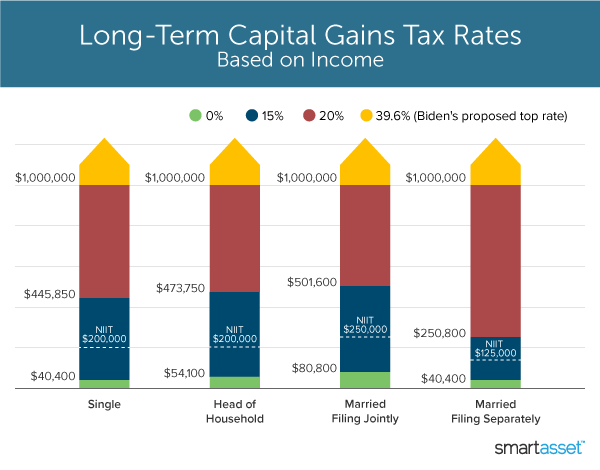

. Substantial capital gains can increase your adjusted gross income possibly changing the amount of tax benefits you receive for various deductions and credits. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. The top federal long-term capital gains rate is 20 which is lower than all but two of the seven ordinary income tax rates.

This will probably reduce your OEICs yearly income as well. The other long-term capital gains tax rates are 0 and 15. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels.

The remaining portion of the capital gain that pushes the taxpayer into the 25 marginal tax bracket is then subject to a 15 percent capital gains tax. Thus we infer that capital structure has a significant impact on profitability. Additional State Capital Gains Tax Information for Illinois The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in.

This is a use it or lose it exemption so it makes sense to take some profits on the OEICs without tax. Created in 2021 the tax was ostensibly labeled. This further results in increase in return to equity shareholders.

These gains have to be within the limit of 10600 for 2012-13. You are entitled to an annual exempt amount of realised capital gains before you pay tax at 18 or 28. It may be because with increase tax rate the quantum of tax shield will increase for a given amount of interest on debt.

The combined rate accounts for federal state and local tax rate on capital gains income the 38 percent surtax on capital gains and the marginal effect of pease limitations which results in a tax rate increase of 118 percent. Here is a. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 Capital Gains Tax Rates By State Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate Capital Gains Tax H R Block

2022 Trust Tax Rates And Exemptions Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 And 2021 Capital Gains Tax Rates Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

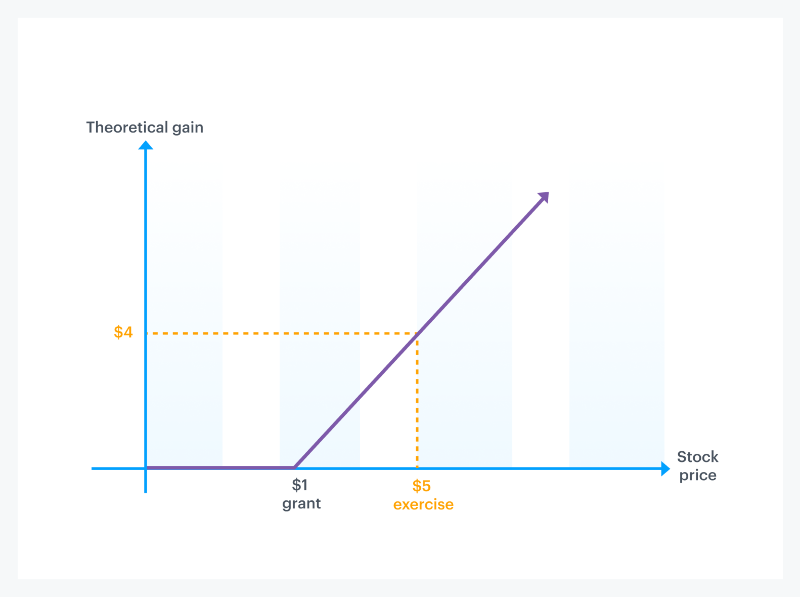

How Stock Options Are Taxed Carta

The Ultimate Canada Crypto Tax Guide 2022 Koinly

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Yield Cgy Formula Calculation Example And Guide